Rydex traders have once again proven their worth as a timing indicator. I never rely on just one indicator but I pay more attention to the ones have been hot and the rydex traders have been on fire all year! I warned yesterday that these traders were being too complacent during this sell-off which argued for further losses down the road....after yesterday's drubbing it looks like they are still not fearful enough. These guys tend to be quite fickle and quite often they will change their behavior on a dime by flipping from bullish to bearish on the first of many rallies, but again, I need to see them do this first and I'm not going to try and anticipate the buy signal.

Prior to the market rolling over I warned option traders and the VIX were signaling complacency. This is rapidly becoming reversed but more work needs to be done. The VIX however has spiked to a high of 31.5 which is close to where it was at the July lows (it reached an intraday high of 33). This is a very good sign that what we are seeing is a correction and NOT the start of another bear market down leg because we are seeing about the same level of fear that we saw when the market was 15% lower. That's a positive divergence. You can think of it this way....the bears have exhausted a lot of their fuel just to get the market down 6%. Soon they will be tired just like the bulls got tired when the VIX hit 20.

Now, we have see last year the VIX go to stratospheric levels of 80+ but it only got that high 2 times in the past 80 years....the 1987 crash and the 1929 crash (a study shows it would have been this high if the VIX existed at the time). But, admitingly it’s also possible for it to go to 40 which is a more "normal extreme". However, like I said before, if a VIX spike of 33 halted a market slide a few months ago, it can certainly do so again especially when the market is at a higher low. If instead the market was at a lower low, it's more likely you would need an even higher spike in the VIX to mark a bottom. That's what happened a lot of the times during the 2000-2002 bear and the most recent bear.

Ok enough talk about the damn VIX. After Friday's sell-off the market is now once again in extreme ST oversold territory but since the market closed right at the lows of the day making a new low for this move down and rydex traders are still showing too much complacency it' doubtful we've seen the final low yet so I'd be careful trying to play for a bounce. If the market gaps down on Monday, then I would become interested but if instead we just rally right away like on Thursday I would again be skeptical of its LT sustainability.

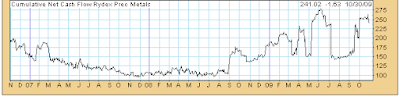

Now, onto gold stocks as promised. I believe there's another down leg or 2 in store in gold stocks as per the behavior of Rydex gold traders. When I showed the following charts in August I argued that that gold stocks were poised to go higher because as per the cash flow chart, Rydex traders remained on the sidelines even as gold stocks were rising which showed skepticism in the face of a rising trend (bullish). Now, the situation is the opposite. Just prior to the drop in gold stocks cash flow into the gold stocks was near historic highs and despite the fact that gold stocks have rolled over significantly, Rydex cash flow levels have dipped only modestly and remain near the highs. This argues for downside potential in gold shares in the weeks to come.

The bottom line is this....we've probably seen the bulk of the decline in the markets since it rolled over from high at 1100 but it doesn't appear that a final low is in yet although encouraging signs of exhaustion are already there. Gold stocks appear especially vulnerable. I'm waiting for the dust to settle before making any significant moves although I may try some small short term trades along the way. I suspect the final low will be somewhere around 1010-1025 and it won't be until mid November at the earliest before the market makes a sustainable upward launch. In other words, we will likely see fits and starts to any rally attempt even if the low gets registered early this coming week.

Be patient and wait for your pitch. It's always tempting to bottom tick a decline or top tick a rally but more often than not it's a recipe for pain. I learned throughout the years it's better to have the wind at your back i.e. making a move when you have some sort of early confirmation that the tide has turned. Only if you see "the whites of their eyes" is it worth trying to bottom/top pick (but not betting the farm). I can be hard to tell sometimes when this happens....it's easier though to identify panic bottoms vs. tops and so I'm looking out for that....

No comments:

Post a Comment