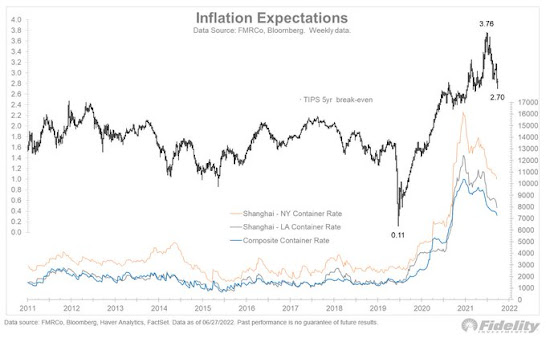

We've had a pretty good run in the market for the past month and a half. We had similar good rebounds twice before this year - one in the spring and one in the summer both of which obviously failed. This time around the rally feels different in some respects. First of all, everyone is calling it a bear market bounce and I don't see any "is this the bottom?" queries. Some sectors like financial and biotech are exhibiting the hallmarks of a bull market advance, namely a strong, relentless low vol move and they have just broken above the August peak although barely. The other thing to note is how the Fed's latest attempts at jawboning the market down is not having the same amount of bite. Monday's decline was driven by comments from Bullard who's saying the Fed funds rate needs to go to 5-7% to fight inflation. With the 10 year yield trending down and comfortably below 4%, the bond market is giving the middle finger to this tough guy stance these Fed guys have. The Fed's "we don't see any meaningful signs of inflation easing" rhetoric is a farce. Maybe part of this talking down the market tactic has to do with the idiotic perception that the wealth effect of a stock market rally would add to inflation pressures. I nailed it when I compared the Feds to inspector Gadget. On Monday oil prices hit an 11 month low and went briefly NEGATIVE YTD yet "we don't see any meaningful signs of inflation easing". 5 Year break even rates have been down trending big time since April and currently stands at 2.29% This is the market's average CPI expectation for the next 5 years. Historically, this has been an accurate measure of what the CPI actually ends up averaging over the next 5 years.. Yet "we don't see any meaningful signs of inflation easing". Idiots.

Getting back to market action. Did you know that despite all the horrific macro developments in Europe all year, European stocks are down only about 9-10% YTD? I don't hear ANYONE mentioning this. Whenever the market is quietly going against the narrative you ought to pay special attention. On October 20th I read a market pundit make this comment "don't expect anything but a bear market rally until the Fed pivots, inflation eases and war in Ukraine is over". The problem with acting on this belief is that by the time those things happen the market will probably be at or close to new all time highs. The markets will anticipate, they will price in information. That doesn't mean it gets it right all the time, but that's what it does. The more you wait for certainty, the higher the price you will have to pay for it i.e. lower the returns you will get. I mentioned something similar in the summer of 2020 as the pandemic was raging. And think about how the markets behaved earlier this year. Stocks and bonds sold off hard from Jan-March well before the Fed did its first rate hike. Markets will anticipate/price in things. It will probably do the same going the other way.

The market is going to face an important test. The last 2 times we had a run like this where it became ST/IT overbought it ultimately fell apart. Can the market consolidate this time and not totally fall apart? From a market action and sentiment/indicator perspective the chances of this look better than before. But what about the inverted yield curve and other ominous macro signs like rising layoffs which suggest immanent recession? They are surely a concern, but if the market can consolidate here before moving higher again, it would suggest that the market is expecting that any recession would be mild and better times lie ahead. How long could such a consolidation phase last for? Typically they take 1-3 months but it's very difficult to predict these types of wiggles in the market. The best we can do is use tactical indicators to help navigate. By the way, I have never seen such a unanimous call for a recession as I do now. This is not to say that since everyone is calling for one it won't happen, but rather that a recession is very likely priced into the market to some degree. If the market can consolidate and break out above August highs it would suggest that he market is looking past any recession or that there won't be one at all. If it's the former, it would suggest the recession will be mild without any financial crisis. There's some good reasons to expect this to be the case. More on that in a future post.

Bottom line is that the latest market action is encouraging but by no means an all clear signal. Let's see how it handles the looming overbought condition.