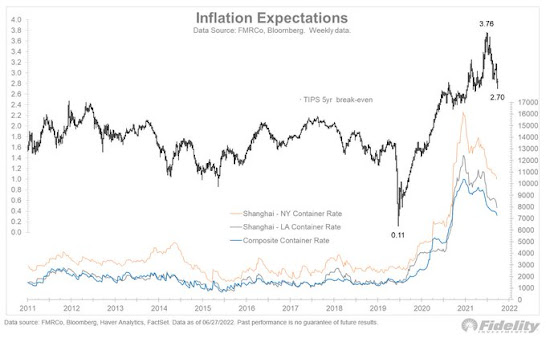

Meanwhile, inflation expectations implied by the bond market have dropped sharply as per the 5 year break even spreads. The market is now pricing in an average inflation rate of 2.7% over the next 5 years.

The evidence is certainly mounting that inflation has peaked. So, is the Fed going to take any of this into account or will they carry on looking in the rear view mirror with their ridiculous plan of hikes to infinity? The fact that the Fed under Powel provides on open book with expected rate decisions for the next 6-12 months is comical. The Fed has a poor track record of predicting inflation as the future often proves to be too uncertain to make accurate predictions. The Fed thinks that by keeping an open playbook it will create less market uncertainty but I believe doing this creates a false sense of certainty which leads to upheaval if the Fed realizes they blundered and have to rapidly change course which is often the case. Last year at around this time the Fed said they weren't going to raise rates until the latter part of 2022 and it would only be small. You can see how such an expectation can lead to complacency with businesses and consumers when in comes to their borrowing and spending decisions. Instead what the Fed needs to do is stop being so explicit and open with their intentions and admit that they can't make long term forecasts accurately enough. Keep the market guessing and on guard to a certain a degree so that expectations don't get too extreme one way or the other. Powel's Fed has been terrible at setting rates. The only glimmer of hope I see that they don't fuck up yet again is that so many people are concerned that they will fuck up that Powell and the Fed are well aware of this. Maybe that will make them more cognizant of the forward looking indicators I posted and they will announce some sort of pivot in July.

If a Fed pivot does happen, it would result in a relief rally but is it too late now to save the economy from going into a deep recession? We are no doubt in a recession right now in the technical sense. The damage of this rising rate environment may have been too been much even if rates have peaked. It could very well be the case that too many dominoes have already fallen. And it's not all just interest rate issues. The deficit has been shrinking which is a detractor for economic growth. At the end of the day the market cares about earnings and if they are slated to contract in a major way, forget about it. We will see SPX 3000 before all is said and done.

Bear markets will not make it easy for pessimists to make money. There are vicious counter trend rallies within them to shake them out and suck in hopeful longs and they usually happen when negativity becomes acute and lots of bearish bets are being made at a time when many would be longs are on the sidelines too scared to jump in. I believe we are in a such a condition. All it takes is a spark to light the fuse unless the wheels simply start falling off fast and furiously before it can happen.

Let's now talk about sentiment and more about what I believe are missing links to declare that we have seen true capitulation. Positioning in AAII investors is the first one. This has proven to be the best indication of lack of capitulation from day 1. The recent allocation was released today and it shows that equity exposure dropped down only to 64.65%. At the peak of the market in Nov 2021 exposure was at 71.4%. Given that this has been one of the worst years in history YTD, the behavior of AAII investors continue to show, as has been the case all year, only a grudging amount of retreat from the market which is indicative of a bear market that has not run its course. Back at peak of the market in 2018 exposure was at 72%, and by the end of year whereby the market had declined 20% from the peak, exposure dropped to 62.4%. At the very least I'm expecting exposure to get to 60% for me to have any confidence that the worst may be over, but that's only in the event that what we seeing this year will turn out to be a mild bear market year as was the case in 2018 and 2011. If we are in a major bear market then there's a long way to go before we have seen true capitulation. At the lows of 2003 and 2009 equity exposure was 46% and 41% respectively.

The other major concern I have is fund flows which like AAII, continues to show only grudging amounts of capitulation. In recent weeks we've seen what I would characterize as mild to moderate outflows given the damage done to the markets. We have seen $30 Billion outflow in the past 3 weeks which is good but not enough to signal an all clear from a LT perspective especially give all the inflows earlier this year. One thing I did notice though is that there was a outflow last week when the market had a rally and so that's actually a positive from a contrarian perspective in the ST.

Other concerns I have which suggest this bear market has not run its full course is bitcoin still at 20K. When bubbles burst, its pretty much a lock to see a 90%+ collapse from the peak. BTC was the biggest bubble I've seen since the dot com days. The hysteria, the scams, the leverage, the amount of dumb money retail and institutional participation, the super bowl indicator - all of this says that 90% + drop is inevitable. Now, it's possible that the market and BTC decouple like it did after it collapsed in 2018 but its less likely given how widespread its reach was this time around. For me, BTC and the meme stocks are barometers of speculation and although they have come off a lot from heir highs, they still show signs of life anytime the markets do and they certainly can and likely will go a lot lower in due time. It can take a long time for traders/investors to move on from the types of stocks that worked well in the previous cycle. This was the case after the tech bubble bursting as well and so many of the junk stocks that eventually crashed 90% + many of which going to 0. It took years for traders to give up playing them. Look at weed stocks for a modern day example as to what crypto and meme stocks will end up looking like in the long term.

Finally, the last thing bothering me is the low VIX and the lack of capitulation its signaling. I've heard it may be due to its "microstructure" as I've seen someone put it., but I'm not trusting that.

So, all in all you can make the case that although we have seen excesses having been purged from the market, its still not enough. That does not mean the market can't have a strong rebound for several weeks. SPX 4000-4200 is quite doable if a bear market rally takes hold due to a Fed pivot or whatever.

I sincerely hope that my longer term negativity will prove to be misplaced. I really hope we can somehow muddle through this year. Like I said, many times, I am trying to keep an open mind but I have to say that deep down I feel that we're fucked.