First off, I was wrong about the ST call I made in the previous post. Markets simply powered ahead rendering overbought conditions even more overbought as the Fed's pivot during the Dec 13th meeting caught literally everyone by surprise. With the market having already such a strong run going into that meeting everyone, including me, were expecting the Fed to push back on the market by talking tough as has been the case for well over a year. Instead, they pivoted penciling in 75 bps in cuts for next year. The market has now since pricing in twice as much. This pivot no doubt resulted in some forced buying by shorts and underinvested fund managers. So, now we have markets that are extremely overbought with some overbullish ST sentiment readings. More on that later.

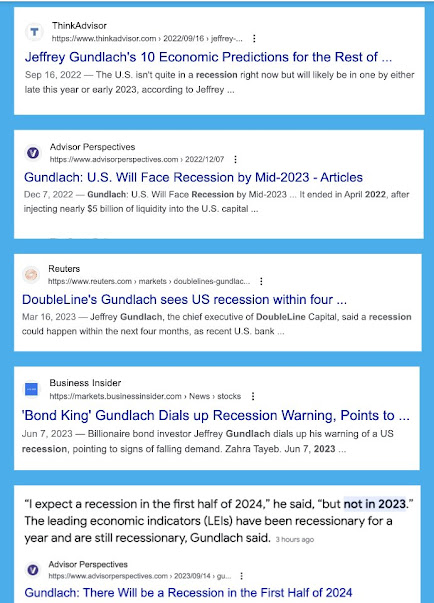

Looking back on 2023 I was spot on for the most part. I had pointed out from the start how expectations were quite low which underpinned my LT bullish posture. My ST calls were mostly right as well. Sure, I got this last one wrong but as I always say, calling the ST is tricky because the shorter the time frame the more randomness plays a factor. There's been plenty of headlines pointing how the unanimous call for a recession in 2023 was wrong. What's the mott of this blog again? For anyone reading this, and I'm not sure if anyone does, how many fucking times must I prove it you that the purpose of the market is to make fools of everyone? In other more kind words, the market will discount the popular narratives out there and so by the time you act on them it's too late. Now, you are hearing a lot of chatter about a soft landing. So, does this mean that this has been discounted and the market is vulnerable to downside surprises? I don't think so. Despite all the talk of a soft landing, it's not even close to being fully embraced. Yes, in the ST you have signs of froth, just was we did in July but then just like now, we aren't at the point where the fundamentalists type managers are fully committed to equities. I listened to several 2024 outlooks from fund companies/strategists and the message was the same for all: be cautious on equities and be overweight bonds vs equities. While there are less calls for a recession in 2024, you won't have a hard time finding them. Guys like Gundlach just keep moving the date forward. What a clown.

According to this set of Wall Street Strategists, the average SPX price target for end of 2024 is 4861. That's a gain of only 2% from here! Last year at this time, the average target was for a 5% gain. So, if everyone is so bullish about a soft landing in 2024 why isn't the average price target in 10-15% range?

Fund managers are less negative vs a year go but there's still a ways to go before they have fully embraced equities.

The inverted yield curve is probably the main thing that's still keeping a lot of people still cautious. What does an inverted yield curve actually signal? It signals that the market is expecting short term rates to decline significantly.\This does NOT necessarily have to be the result of a recession, it can be the result of inflation normalizing now that we don't have dire supply chain issues and acute labour shortages. Yes, onshoring and the like could result in longer term inflation pressures, but inflation has clearly been on the downslope and since the Fed raised rates so aggressively to supposedly fight the inflaton (which it did not), then it follows that they will lower rates after it has been painfully clear that the inflation storm has passed. A 5.5% fed funds rate is simply not justified even if inflation were to run at 2.5- 3% going forward rather than the 2% Fed target. Therefore, the inverted yield curve could possibly be signalling a recalibration of ST interest rates is coming which doesn't necessarily mean recession. In prior instances when the yield curve went inverted, did it ever happen after a pandemic induced inflation episode? No. Therefore, it would be naive to just blindly apply the inverted yield curve recession signal to our current situation. Yes, it was different this time! The pandemic induced inflation and labor shortage has also given false signals to other indictors like the SAHM rule and credit card delinquencies. I'm not going to go into details with these, all I will say is that look at what levels therese indicators are rising from....it was either at or close to historical lows and now look at at absolute levels. One word comes to mind: normalization.

So, bottom line is that the there is still plenty of room for the market to rise longer term before everyone is truly all in. The ST is dicey however as once again the CTA types and other momentum based traders are pretty much all in. The tactical indicators are as stretched as there were in late July which as we know was followed by a 10% correction during the subsequent 3 months. With the SPX flirting with all times high, don't be surprised to see it stay sticky until we surpass it but whether or not that happens, you will most likely get a better entry point if you remain patient. Never chase the market. I've seen a few different momentum/breadth studies which have shown that when the market has been so strong as it has been, it's actually a strong bullish signal 12 months out with gains of 12-15%. in the offering. So keep that in mind if things get rough. I have some more things to say but I'll save it for a future post coming soon.