This is that time of the year when I look back and look ahead as to what might be in store. Looking back, a year ago at this time I pointed out how expectations for 2024 were low despite some chatter/hopes for a soft landing. At the time there were also still plenty of doubters calling for a recession such as jokers like Gundlach who had been repeating the same call since 2022. The median price target issued by Wall Street Strategists for 2024 was for a measly 2% gain. This low expectation environment made me bullish for 2024. Not only did the market make fools of the majority but it even surprised the most bullish of the bulls and it did so with below average volatility. We had one, 9% correction in July and a few 3-5% corrections. Folks, how many fucking times do I have to remind you of the motto of this blog? It is there for a reason! In a nutshell, 2024 was a great year because we transitioned from the skepticism phase of the bull market to the optimism phase. But now we are seeing clear signs of excessive optimism and reckless speculation which is no bueno.

I started seeing the first signs of excessive optimism in July as I had pointed out at the time. There's been plenty more red flags piling up since....where do I start? Positioning by fund managers towards equities and cash levels are near historical highs and lows respectively, which is the the opposite of what was the case at the depths of the 2022 lows.

Equity fund flows have been massive this year, especially since the election. On December 5th at the recent peak, there was about a 14:1 ratio of leveraged long vs leverage short ETF positioning. The last time this happened was December 2021.

Just like in 2021, we are seeing ridiculous speculation in crypto led by charlatan Mike Saylor shamelessly pumping BTC saying stupid shit about how MSTR market cap will surpass Microsoft. You have ridiculous meme coins like DOGE and fartcoin doing moonshots attaining a "market cap" of $1 Billion! Come on man. This is clearly a moment where you could look back a year from now and say "ya, that was a clear sign of an imminent market peak" because there is nothing more speculative than people trading meme coins, willing to gamble their money on pure air. The fact that the action in fartcoin and other memecoins can even happen just proves what I've been saying about crypto all along....it is entirely a function of the greater fool principle. I will admit though, that I have woefully underestimated the degree and length of this crypto craze. As I had stated previously, BTC had first mover advantage and so that's why it is more "legitimate" than any other crypto out there, thereby attracting the most money. But in the end, it is fundamentally worthless just like fartcoin and its value can only be sustained on faith and an ever increasing amount of money flowing into it. We may be at point now were a BTC crash could have systematic risk to the rest of market and perhaps even the economy...I don't know that for sure, but the risk of this is a lot higher than at previous peaks.

Here's a survey which gauges the expectations of stocks by the average Joe...it's at the highest level ever.

What about Wall Street Strategists? The median price target for end of 2025 is 6600. That's about an 11% gain from here. So, now these guys get bulled up after the market has risen 60% in 2 years and after being humbled 2 years in row calling for 5% gain in 2023 and 2% in 2024? Lol. Talk about Johnny come latelies. We've also seen capitulation recently from some the staunchest bears out there like Mike Wilson and David Rosenberg. Here's what Rosenberg said on Dec 5 (right at the latest market peak) "The remarkable surge in the S&P 500 over the past two years has truly surpassed my expectations, especially in the last twelve months. Given that this bull market has persisted long enough, those of us who have found ourselves on the wrong side of the trade must consider adopting a different strategy. My latest memo is in no way a throwing in of any towel, rather an effort to discuss and interpret the message from the market that may not actually be altogether that irrational". Lol. Sounds like throwing in the towel to me!

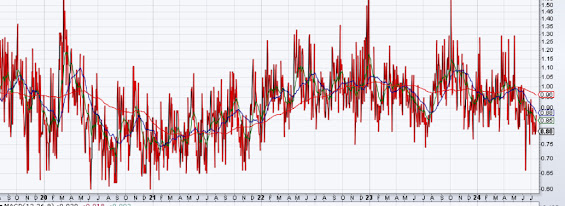

We've also seen a massive underpermance of value vs growth recently and large cap vs small cap, a disparity which is similar to that of 2000.

The rout in bonds has accelerated this trend in recent weeks but the growth over value trend has been ongoing for years. Bonds by the way, are being shunned which another major shift in expectations. Coming into this year most strategists were recommending to be overweight fixed income as expectations for several rates cuts in 2024 fueled by recession fears no doubt. Now, the expectations for bonds are the opposite of what they were last year at this time as inflation fears have come back to the fore. It's expected that the Fed will pause and cut perhaps only a couple more times in 2025.

In prior posts I mentioned that a surge in margin debt and IPOs would be the tell tale sign of a major top. We have seen the former pick up but not the latter. I would also categorize the increase in margin debt to be not be as extreme as it was in late 2021...at least not yet.

Then there is the BofA bull bear indicator. This is one of my favorite indicators. It is showing a bizarre divergence from the vast majority of other indicators which are flashing red. Unlike most indictors which showed a burst in exuberance since October, this indicator went the other direction and has declined from 7.2 to 3.4 and may be even lower now!

What is going on here? This indicator is based on global flows and positioning, not that of the US. The main driver of souring in sentiment is global fund flows, nemely, massive outflows in China/emerging market stocks. In my October post I pointed out the opposite taking place and how my hypo-meter was flashing red for China. Well, now that the hype has died down, I would say China and emerging markets are in a better position to form a base. Positioning in hedge fund and Long Only managers are neutral overall and even when the BofA indicator was at 7.2 it never hit the sort of extremes we saw in 2021 just prior to the market peak. So, in conclusion, the BofA bull/bear indicator has not flashed red like the majority of other indicators I look at and is actually not far away from giving a buy signal! Remember though, this indictor pertains to global markets, not the US.

So, in conclusion, there's plenty to be concerned about in 2025 as the wall of worry which propelled the bull market in 2023 and 2024 has all but crumbled. There are bulls like Ken Fisher who still think we are still early in the optimism phase of the bull market. Sorry Ken, I can't agree with you here. Valuations are high, speculation is palpable and complacency has replaced concern. Back in July I postulated that we were in inning 6 or 7 of the bull market. Well, I say we are in inning 8-9 now. I'm calling for a down year in 2025, flat at best. There could however, be pockets of opportunities in value, small cap, emerging markets and bonds. I will discuss this and more in my next post.