Here's the good, bad and the ugly for 2010

The good

- Correctly identified and stayed in harmony with the primary bullish trend of the market

- Correctly predicted and prepared for a multi-month consolidation phase of bull market coming into 2010

- Cashed in on big winners bev.to and gdc.to for multi-baggers

- Avoided the summer meat grinder by remaining largely in cash

- Re-entered the market in late August/early September near the lows and established positions early in a strong sector - small cap Canadian energy services.

- Avoided ST trading and counter-trend trading i.e. shorting the market trying to profit from corrections

- Disciplined in selling losers early taking no major losses on any one position

- Added more to winning positions (but not always) which ended up going even higher

The bad

- Did not fully capitalize on all opportunities because I was too picky about certain indicators and market action...I wanted everything to be just perfect and as result I only partially committed at times.

- At times was too focused on ST wiggles of the market. Although I didn't trade them (given my preference for individual stocks), it over influenced the decision making towards the individual stocks I had on my radar most of which didn't even respond very much to ST wiggles anyways.

- Didn't get aggressive by pressing bets when at times I should have

- Cash position too high overall - at times high cash position was warranted, but other times it wasn't

The ugly

- prematurely sold positions psv.to and mal.to leaving huge money on the table out of fears that a ST correction near the end of the year would be detrimental to my year end compensation. This was a violation of my "don't turn an investment into a trade or vice versa" rule. Yes, I'm still bitter about this.

Part of the reason I have been overly conservative since I've started doing this full time was that I wanted to start things off on the right foot for both myself and my clients and so I kept large cash reserves in cash in case I messed up early. The other reason is that despite what you might think, I'm still not 100% confident in myself. Although I have 12 years of experience and I honestly believe I have a knack for this, I have only been doing this full time for 2 years and so I haven't proven to myself yet that I can actually do this long term for a living. Also, there's quite a difference when you trade while having a full time job as your main source of income compared to when you rely solely on trading for your income...you can afford to take a lot more risks in the market when you have a full time job. But now that I have had 2 good years under my belt, it has given me confidence and breathing room financially and so now I have the ability to be more aggressive. I know 2 years proves little but so far so good.

Next year should make for another interesting one. There's lots of important questions that will be answered such as: How will the situation in Europe resolve itself? Will jobs in the US start coming back signaling a self sustaining recovery? Will the fed start raising rates? Will Gold and commodities in general hit some sort of peak? Will natural gas hit a bottom (or perhaps it already has)? Huge opportunities will present themselves next year given the potential for some major turning points. Next year is the 3rd year of the presidential cycle which tends to be the most positive one from a stock market perspective. By no means do I place a big emphasis on "cycle theories", however, in bull market conditions any kind of indicator, or study that's flashing a bullish message tends to be effective whereas any kind of bearish omen tends to give muted negative results or false signals. Remember the bearish Hindenberg Omen and death cross in the summer? Massive bear traps.

Let's take a look at Wall street consensus expectations. The average Wall street strategist target for the SPX a year from now is 1374. That's about a 9% gain from current levels. Last year strategists predicted about the same return for 2010, as the average year end target was 1222. This ended up being conservative but not very far off the mark. According to the latest consensus forecast published by Blue Chip Economic Indicators, the economy is expected to grow 2.6% in 2011. That's a pretty sluggish growth rate. Economists predicted sluggish growth last year as well and they actually got it right....for once but I don't think they'll be right this year. So, overall, I would say that Wall street is cautiously optimistic at best about next year. This leaves room for the market to surprise either on the downside or upside. I'm thinking the latter happens. Few pundits are expecting significant job gains next year even though leading indicators for jobs such as the downtrend in initial claims for unemployment are on the cusp on signaling so. In addition, the uncertainty regarding the tax cut situation has lifted and is bullish, corporate profits have been building solidly for over a year, there was no double dip and existing workers are being stretched. How much longer can companies hold off hiring given all this? It's just a matter of when, not if jobs start coming back strongly if you ask me.

As I've been pointing out time and time again, there continues to be underlying, deep rooted skepticism about

the market and the economy from people with the poorest track records - the typical retail schmuck trader, in addition to the average main street guy who still thinks we are in a recession. Meanwhile, the market is up over 80% from it's low almost 2 years ago in strong opposition to the schmucks. Who do you think will be proven right? Most of the schmucks didn't benefit during this bull run, in fact, many of them actually lost money betting against the market (which proves why they are schmucks).

Ever wonder why most people don't make money in the stock market in the long run? It's because they do the obvious or the easy. It's easy to bearish when the unemployment rate is high and headlines are negative, just like how it's easy to be bullish when unemployment rate is low the economic skies are clear blue. In life it's the same thing...if you always take the easy path you won't be a successful person. It's easy to eat junk food, it's easy to sit on the couch and watch TV all day, it's easy not to ask out that girl you like and just play it safe. What makes a successful person is one who does things that most people aren't willing or can't do. That means hard work, doing difficult and courageous things, sacrificing, being disciplined and thinking outside out the box. This is probably the single most important life lesson I will try to instill in my daughter.

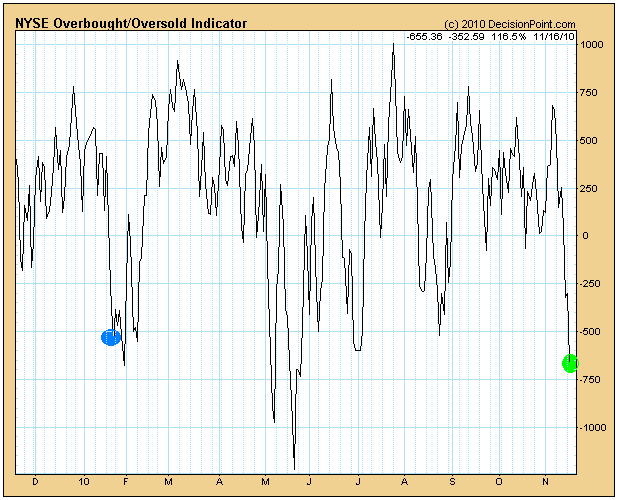

I'd like to say some things about current sentiment conditions. The fact that everyone including my grandmother is pointing out how bullish sentiment is at an extreme right now makes it likely that the big correction everyone is waiting for will be elusive. I've said this before....a watched pot never boils. Instead, it's more likely any dips will be modest for a while and then a bigger correction happens sometime in February or March. That's my best guess and I don't give a shit if I get right or wrong because I'm not going to worry much about the dips and corrections. I'm going to focus on the bigger picture and the promising stocks/sectors within this bigger picture. It's important to keep tabs on how your stocks are behaving with the day to day movements of the market. The less they are moving in tandem the less you should care about the ST and IT moves of the market and the more you should be care about company/sector specific fundamentals.

I believe next year will indeed be another bull market year but most of the gains will happen in the second half of the year. The reason I believe this is because, as the bears have been desperately pointing out, the market is overbought and several sentiment indicators are at bullish extremes. But unlike the bears who think such extremes are signalling a bull market peak, I believe it's signalling a ST/IT term peak. Now, I've said it here many times, trying to profit from corrections in bull markets is often very difficult and frustrating and should be avoided. If you're ever ST cautious in a bull market and you can't sleep at night, fine, raise some cash but don't short. In 2011 my goal is to continue to focus more on individual names and sectors and less on the wiggles of the general markets. I hope to have the courage to act more on my convictions when it's warranted.

There will very likely be at least 1 time in 2011 where market sentiment will swing in the opposite direction showing excessive bearishness due to some scare so be patient and wait for it because that will be the time to get aggressive. It's possible for it to take weeks, or months for it to happen while the market still grinds higher but it will happen and when it does any gains in the interim will be wiped out rather quickly. But don't let this stop you from buying a stock that you believe has tremendous upside coming it's way because of favorable company or sector specific catalyst/fundamentals. So long as you don't believe the bull market is in danger of being over, fuck the ST market wiggles and have the courage to just buy it..or at least get partial exposure.