Yes, I said Jackass Hole...more on that later. First off, so much for the yen carry trade meltdown. I thought the yen carry trade was such a big driver of US stocks for the past x number of years? Hyperbole just like I said. The market has recovered all the losses from a couple weeks ago and is closing in on the previous all time high. At the lows we saw excesses get purged as I had pointed out. Sentiment had been sufficiently reset for a solid low, but now with this V shaped move, some excesses have quickly built up again. Put/call ratio these past few days have collapsed back to the complacent levels seen at the July peak. Apparently the CTAs are slated to be buyers over the next few weeks whatever the market does lol. There's guys are hilarious. They puked everything near the bottom and now buying it back 10% higher. AAII sentiment released this morning shows 2:1 bull to bear ratio, the same as where it was in mid July. NAAIM exposure which had dipped back to 56 last week is back up to 75% - not extreme but notably higher. So, all in all, the ST condition of the market is now stretched. However, having said that, there are some ST-medium term sentiment resets which still have ample room to unwind further. Fear/Greed index sits only at 54 for one. Hedge fund and mutual fund positioning had a significant unwind in tech stocks which is still in place. I read an article on marketwatch which says tech stocks make up 16% of hedge funds portfolio. Compare that to the S&P 500 which has a 30% weight, it seems modest. Apples to oranges you might say. Fair enough, but what about this: According to Goldman, US mutual funds are the most underweight tech stocks in 10 years. When the Mag 7 were getting hit a few weeks back, I saw a lot of chatter about how the AI bubble may have popped citing the same concerns I had listed in my July post. That to me is a sign that such concerns will end up being premature at the least or wrong at the most. You see, when a bubble truly bursts you tend not to see major bubble-pop proclaiming come out until after major damage had been done i.e. 40-50% type damage. I had estimated in July that we could have up to another 9 months before the AI party would be over. As I had mentioned, the major thing missing to flag a major peak in AI is a flurry of IPOs. It would appear that the recent rout in tech was simply a reset from a very overbought condition. We shall see...

So, the main event at Jackass Hole is tomorrow. Expectations appear to be high for Powel to deliver a dovish message. The market is clearly expecting rate cuts to start in Sept which is pretty much a lock. So, what's the expectation? Are we primed for a sell the news reaction if Powel hints that only a 25 bps cut is in the cards? I know there's folks out there who want to hear that Powell is willing to consider 50 bp rate cut. The futures markets is currently pricing in only about a 30% chance of this happening but futures markets can be fickle. A couple of weeks ago I believe this percentage was around 80% but don't quote me on that. Given the ST overbought conditions of the market, ir would not surprise me to see a knee jerk decline post Jackass Hole, especially if Powell delivers only a mildly dovish tone.

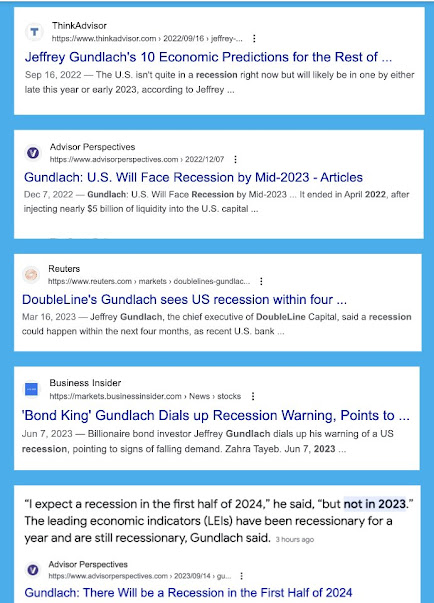

The obsession with the Fed dates back to at least 1998 when they did emergergy rate cuts in response to the LTCM debacle. Given all the crises that we've seen since then, the Fed has been viewed as this omnipotent force that pulls all the strings of the market. "Don't fight the Fed" is a mantra that's ingrained into everyone's psyche. Well, if you look at history there's times when this has turned out to be true and other times where is hasn't. 2023 was a great example of how fighting the Fed by being bullish was the right move as they were still hiking rates. 2001-2002 was another time when fighting the Fed was the right move by being bearish as they cut rates aggressively. Never blindly follow popular Wall Street adages. Context matters and markets are not meant to be so obvious otherwise we would see a far greater percentage of active managers beat the market. I clearly remember in Jan 2001 how CNBC was celebrating the Fed's first rate cut which was 50bps. They showed a statistic that the market was always higher 1 year following such a rate cut except for 1929. At that time I was a bear and I remember thinking "and what happened in 1929? It was the bursting of a stock market bubble, the same was this time!"

So, what is the context of rate cuts this time? I know there are some people hopeful about it but I also see plenty of people showing an ominous chart of when rate cuts have started from elevated levels like this i.e. 2001 and 2008. Once again, people are just blindly adhering to analogs without taking context into consideration. The rate cuts in 2001 and 2008 were a response to a clear deterioration in the economy. This time around, the rate cuts are slated to be in response to clear deuteriation in the rate of inflation - an inflation episode which had been the result of a pandemic rather than structural issues. The economy, while having slowed is still healthy. Of course, this can certainly take a turn for the worse but as it stands now you can't argue that the US economy is showing deterioration comparable to that of early 2001 and early 2008. You can't argue that the consumers and/or businesses are as levered as they were back then either...not even close. You can't argue that credit spreads were blowing out as they were back then either. Again, I'm aware that things can change rather quickly but as it stands now, the situation we are in is not comparable to 2001 or 2008. The one thing you can argue is that valuations are historically high on some traditional measures, but that in of itself is not a predictor of major market peaks. But isn't the Fed behind the curve? Yes they are, but it doesn't matter as much as people are making it out to be. The bond market is doing some of the heavy lifting of the Fed already as long rates have declined notably in anticipation of lower short rates.

Inflation subsided naturally, not because of the Fed. I've stated this ad nauseum for the past 2 years that this would be the case. As I predicted in my Inspector Gadget Fed post back in 2022, everyone is giving praise to the Fed for squashing inflation when in reality it was natural market forces that did the heavy lifting. In the US, rate hikes took place at a time when a lot of debt was termed out and generally speaking rate hikes can have conflicting effects on inflation because on the one hand it can crimp loan demand but on the other hand it can stifle supply as it raises the cost of capital, which in turn can raise the cost of goods and services and it also creates more money in the form of higher interest payments to savers. Since the inflation episode we had was largely due to a supply shock I would argue that hiking rates probably did more harm than good when it came of fighting inflation given its impact on supply side of the equation. I have argued that consumption is stable and generally inelastic and so hiking rates would have limited impact on it,. I was correct and yet it was the consumer that the Fed was targeting with their hikes. Deep down they were thinking "hopefully the rate hikes will create some unemployment which would cool off inflation". A naive and hopeless notion, which did nothing to address the actual cause of the inflation which was the supply side shock. Anyhow I digress.

Bottom line here is that this market is likely going to be in highly emotional state for the next few months given the inflection point in monetary policy. The narrative can easily go from "rate hikes are good" to "rate hikes are bad" to explain why the market is going up or down because everyone is so Fed obsessed. Add to the mix the election clown show that awaits us and the dreaded months of September and October. But at the end of the day, it's all about earnings. Are earnings going to be in tact? That's what matters and that's the main question one should focus on. So long as they are slated to remain in tact or improve, everything else will be just noise, as scary as the action may get. I know that can be difficult to have faith in when you're actually in the midst of bad market action because I know I myself always can't help but have doubts. This is one reason why I do these posts as I can look back to see what my logical/intuitive brains was thinking when my emotional/privative brain starts flaring up. If the market starts declining from here, I bet you're gonna get lots of fretting about a dreaded double top. Let's see how things play out....