1. Institutional investors who as a group shunned gold when it was below $300, smugly dismissing it as trading vehicle, now love it over $1000 and advocate it as must have legitimate asset class.

2. Central bankers who in the 1990's were tripping over themselves to sell their gold reserves when it was sub $400 now want to buy when it's $1100.

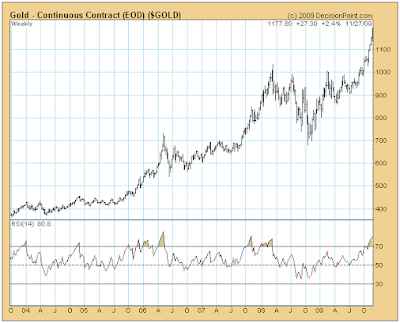

3. The LT gold chart is exhibiting a parabolic formation. Parabolas are the signature of a bubble.

4. Very few in the financial media are claiming gold is in a bubble even though its parabolic behavior suggests one.

5. The price action of gold or the US $ has been mentioned on TV dramas and in the movies. Whenever you see this happen the trend in question is usually in its final stages. By luck, last week I caught part of an episode of a show called "Criminal Minds" whereby one of the characters was checking the price of gold which he had invested in. In the Movie "2012" the strong value of the Euro is mentioned a few times (which is in turn reflects the recognition of a weak US dollar). I also recall hearing non-financial news anchors on TV mention that the long term trend of the dollar is down.

Using sentiment to identify LT turning points is tricky. As I've mentioned before, in a bull run the natural emotion is bullishness and so you have to be careful as a contrarian to say that there's too much bullishness for a bull trend to continue. Only when there is extreme/euphoric bullishness can you say that a LT reversal is imminent. But how can you tell for sure that there's been an extreme? You can't....and often times an extreme can simply get to more extremes. But, you can certainly know if you are getting near the end of road when you see certain behaviors such as the ones I described above. But if I had to just pick 1 indication of an extreme it would be the sign of the parabola on a LT chart. There's nothing subjective about price action....a parabolic LT chart has always indicated a bubble and typically results in a collapse of 70-90% from peak levels.

You need to be careful in distinguishing ST parabolas from LT ones. Sometimes you will see a stock make a "mini-parabola" on a 1 year chart. That doesn't necessarily indicate a LT concern...in fact it may suggest the opposite and indicate further LT strength is likely after perhaps a pullback. To identify LT parabolas you need to use a 20-30 year chart.

Another issue with parabolas is that it can be quite tricky to catch the top. A steep parabola can simply become steeper before finally imploding. So, how can you spot the ultimate top? There's a couple of ways. First of all at the ultimate top, you will very likely see the price of the asset in question reach a very extreme overbought reading on the RSI indicator of 85+ on both a weekly and monthly basis.

With Gold we actually saw this happen at previous IT tops in August 2006 and March 2008 which resulted in corrections of about 25% and 30% respectively. So, if we see these types of overbought readings we can expect at least a significant correction. We're not there as of yet with gold right now.

Gold Weekly

Gold Monthly

As you can see weekly RSI is overbought but not the monthly RSI. If this is the final blow-off phase of the gold rally or even if it's approaching an IT top like August 2006 or March 2008, then any pullback in gold right now would likely be limited to about $1100-1120 before making the last and final surge to perhaps around $1350-$1400. This seams ludicrous but that's what's possible if you look at the situation objectively.

So, anybody out there trying to top pick gold beware....a pullback to $1100-1120 is certainly doable but if after that the price of gold can consolidate for a week or 2, watch out because it's probably setting up for a final and spectacular surge. This type of behavior is quite common with the final phase of a LT trend...it's what I call Phase 3 whereby most of the general public has been aware of the trend for some time and it's being fully embraced by investors (Phase 1 is denial/disbelief and Phase 2 is initial recognition by investors). It can be quite profitable to ride this phase but also scary and dangerous.... you don't want to be left holding the bag.

• National Insurance Company and ICICI Lombard may take a combined hit of Rs 300 cr from the fire that gutted the manufacturing unit of Haldiram’sstock market tips

ReplyDelete