It's been a while I know. Trump assassination attempt and now Biden stepping down...wow. Both these events are once in a lifetime type shit and they happened in just over a week. Since my last post the market has chugged higher with only minor pullbacks and we are in the midst of a pullback now. I'm seeing some things that are worrisome for the market. This whole AI driven run feels to me to be over hyped or at the very least, more than discounted in the short to medium term. First of all, just look at the charts of these stocks - they are parabolic. Using my "waking up from a 5 year coma" perspective, if I saw a chart of NVDA it would scream bubble to me...or at the very least very overextended. The brother -in-law and client of my branch manager, a person who is known to do the wrong thing at the wrong time when it comes to getting in and out of the market, had inquired about AI funds recently. I mean Jesus Christ, where were you a year ago? Hiding in cash is where. I just read a really good report issued by Goldman Sachs in late June which discussed the AI boom via interviews with some of Goldman's highly ranked analysts and a professor from MIT. It provided both positive and skeptical points of view. The main points of the skepticals are that there's been a lot of spend and not much to show for in terms of a return on investment and there doesn't appear that this is going to change anytime soon. AI is costly to implement and yet there's no "killer app" which is going to move the needle significantly enough to justify the investment generally speaking. Whatever automation benefits AI does currently provide is simply not enough to justify the high cost since AI is not capable of doing complex tasks. Replacing just the simple tasks using AI doesn't move the needle much given the costs. The optimists will counter that AI costs will decline over time just like all new tech innovations tend to and that AI will be able to ultimately replace 25% of all work tasks, but even they concede that this is not expected to happen anytime soon and that currently it's a story of "if you built it, they will come". I side with the skeptics on this AI debate. So far it's been primarily the picks and shovels companies who have benefited i.e. the NVDAs of the world. But it seems to me that it's just a matter of when not if, all of this AI spend peaks and then declines as companies who have been investing in this realize that the return on investment is just not there. There has been a big case of FOMO with AI spending and it appear that many firms don't even have a gameplan on how to incorporate it. There's also the risk of AI backfiring in some cases as companies try to incorporate automation too quickly or incorrectly as they feel pressured to do something with it. Lot of people, even one of the skeptics in this GS report, think that there's still a ways to go before we see the "bubble bust" for these picks and shovel companies. I don't share that notion. Based purely on the duration and intensity on the hype, my gut instincts tells me the end game is coming sooner rather than latter - within the next 9 months is my best guess.

According to the Economist, MSFT, AMZN, META and GOOG plan on spending $200B in AI this year which is 45% more than 2030 which itself was a huge spend. Venture capital firms have been tripping over themselves investing in AI start ups - they invested $27B in Q2 alone. The last time there was a frenzy like this was with blockchain companies back in 2021....and how did that go? What is the killer app for blockchain? Shitcoins? The hype was similar to AI now. What's missing to mark a peak is an AI IPO frenzy but I suspect that's coming soon.

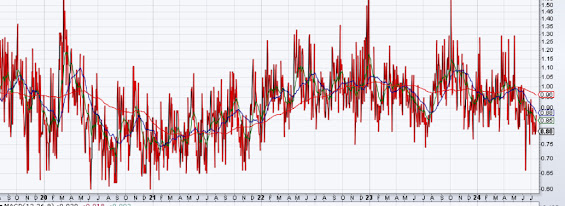

There's other things that were and are bothering me about the market from a short term point of view. There's been a lot of FOMO in general from market traders similar to that of last year at this time. Once again CTAs had piled in to the long side like lemmings just prior to this recent pull back. Put/call ratios had finally given up the ghost as well. Remember how I have been saying for quite some time how they were elevated? Not any more. Fund flows have spiked including those that bet on bullish leveraged ETFs.

This chart would suggest an ominous bull market killing euphoria but it's only one indicator. Also, it could end up being the case that the peak happens at a significant higher high as was the case in late 2021.

The put/call ratio while showing low readings recently is not at the extreme lows we saw in 2020/2021. So, it could very well be the case that we saw a ST peak, not the bull market peak.

And then there's the BofA bull bear indicator. If I was forced to only follow one market timing indicator, it would be this. It is currently at 6.5 which is the high side of neutral. Bull market peaks or severe corrections of 15%+ have not occurred until we saw a reading of at least 8 and we are one surge away from that. We can still however get 5-10% corrections at current readings or lower as was the case last year and so for now, it's suggesting no greater downside than that.

AAII investors allocation to equities has just broke above 70% in June which is where the market tends to run into trouble. The last time it broke 70 was March 2021 and it hovered there until the market peak of Nov 2021 and so although the market didn't peak right way when it broke 70, it was a signal that the bull market run was much closer to the end than the beginning.

So, all in all it would appear to me we are in inning 6-7 of this bull run. There is still room for one last euphoric push higher before the year is over. Perhaps that happens once the Fed starts cutting rates. Everyone is such a monetarist "zombie" to borrow a term from Mike Norman. Most seem to think that monetary policy is the end all and be all of the market. They were largely incorrect in being bearish as the Fed raised rates and they may very turn out to be incorrect again if rate cuts are celebrated as an "all clear" to buy stocks. Initially, yes, Fed rate hikes were bad for the market but the market essentially bottomed in June of 2022 (October was slight lower low) when the bulk of the rate hikes still lied ahead.

I suspect there's still a significant amount of money on the sidelines still clinging to their 5% HISA/T-bills who are on the verge of capitulating and getting back into the market. Rate cuts would be the trigger to squeeze out a lot of these folks. I know I'm getting quite ahead of myself here. As always, I defer to the indicators but I will say that for the first time in quite some time, I'm getting worried about the market.

In my next post I'll discuss what may be a possible regime change that is immanent.

Hello

ReplyDelete